Invoices

Invoices are the core of Paydough's billing system. This guide covers everything you need to know about creating, sending, and managing invoices.

Related docs: Quotes | Recurring Invoices | Products

What is an Invoice?

An invoice is a billing document that requests payment from a customer for products or services. In Paydough, invoices can be:

- Created manually for one-time billing

- Generated automatically from accepted quotes

- Created from recurring invoice templates

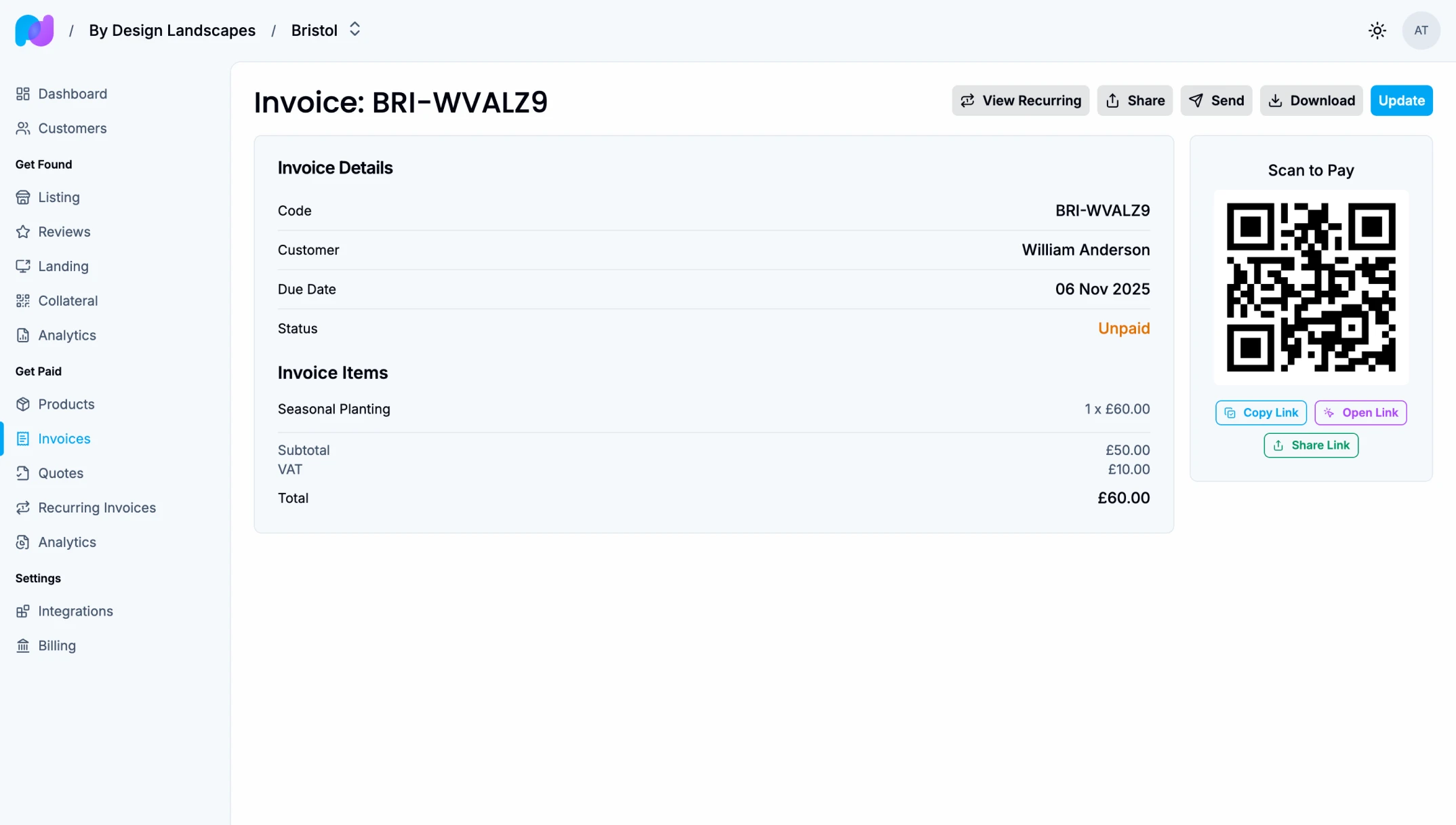

Each invoice gets a unique invoice code (e.g., NYC-A1B2C3) that helps you and your customers track billing.

Creating an Invoice

Manual Invoice Creation

- Click "Create Invoice"

- Enter customer information:

- Choose from your customers

- Email address (required for sending)

- Add line items:

- Select a product from your catalog, or

- Enter a custom description and price

- Set quantity for each line item

- Configure invoice details:

- Set the due date

- Add discounts (percentage or fixed amount)

- Review the total amount

- Save and send

Understanding Line Items

Each invoice contains one or more line items that detail what you're billing for:

- Product: Link to a product in your catalog

- Description: What the customer is paying for

- Quantity: How many units

- Unit Price: Cost per unit

- VAT Rate: Optional tax percentage (if applicable)

- Total: Automatically calculated (quantity × unit price)

You can add as many line items as needed to represent the full scope of work. If you use products from your catalog, they can include default prices, descriptions, and VAT rates to save time.

Adding Notes

Include additional information on invoices with the notes field:

- Special instructions for the customer

- Project details or context

Notes appear on the invoice email and PDF, so your customer sees them alongside the line items.

Tip: Orders from your landing page automatically include any notes the customer added during checkout.

Adding Discounts

Discounts reduce the total invoice amount. You can apply:

Percentage Discounts

Reduces the total by a percentage (e.g., 10% off):

- Enter the percentage amount (1-100)

- Applies to the subtotal of all line items

- Example: 10% off a £100 invoice = £10 discount

Fixed Amount Discounts

Reduces the total by a specific amount (e.g., £50 off):

- Enter the dollar amount

- Deducted directly from the subtotal

- Example: £50 off a £100 invoice = £50 discount

Important: Discounts are applied before VAT/tax calculations. If your invoice includes tax, the tax will be recalculated on the discounted amount, not the original subtotal.

Sending Invoices

Once you create an invoice, send it to your customer:

- Click "Send Invoice"

- The customer receives an email with:

- Invoice details and line items

- Total amount due

- Due date

- A link to view and pay online

Customers can click the payment link to pay immediately.

Invoice Status

Invoices have two statuses that automatically update based on payments received:

Unpaid

The invoice has been created but payment has not been received. Unpaid invoices:

- Appear in your accounts receivable

- Can be edited (line items, discounts, due date)

- Can trigger automatic reminder emails

- Show in aging reports

Paid

Payment has been received and processed. Paid invoices:

- Are removed from accounts receivable

- Show in your revenue reports

- Cannot be edited (must revert to unpaid first)

- Track payment date for record-keeping

Payment Collection

Paydough uses Stripe to process secure payments. There are two main ways to collect payment:

1. Customer Pays Online

The customer clicks the payment link in their email and enters their payment information:

- They're taken to a secure payment page

- They can view the full invoice details before paying

- Payment is processed immediately through Stripe

- The invoice automatically updates to "Paid"

The PDF invoice also includes a QR code that links to the payment page, making it easy for customers to pay from their mobile device.

2. Manual Payment Recording

If you receive payment outside Paydough (check, cash, bank transfer), you can manually mark the invoice as paid:

- Mark the invoice as paid in Paydough

- Invoice status updates to "Paid"

- Payment is recorded for tracking and analytics

Note: Payments must be for the full invoice amount. Partial payments are not supported. See Financial Analytics to track all payment activity and outstanding invoices.

Invoice Reminders

Paydough automatically sends reminder emails for unpaid invoices:

- Reminders are sent on the due date

- Customers receive a link to pay

This helps you collect payment faster without manual follow-up.

Viewing Invoice History

Track all activity related to an invoice:

- When it was created

- When it was sent

- Payment attempts and results

- Any refunds issued

This history helps you understand customer payment behavior.

Refunding Payments

If you need to refund a payment that was processed through Stripe:

- Open the paid invoice

- Click "Refund" on the payment

- Enter the refund amount (can be partial or full)

- Confirm the refund

How Refunds Work

Refunds are processed through Stripe and:

- Return money to the customer's original payment method

- Typically take 5-10 business days to appear on the customer's statement

- Are tracked in the payment history

- Can be partial (refund some of the amount) or full (refund everything)

Multiple Refunds

You can issue multiple partial refunds on the same payment, as long as the total refunded amount doesn't exceed the original payment.

Invoice Status After Refunds

- Partial refund: Invoice remains "Paid" but shows as partially refunded

- Full refund: Invoice remains "Paid" but shows as fully refunded

The PDF invoice will show refund amounts clearly, so both you and your customer have a complete record.

Managing Multiple Invoices

Filtering and Searching

Find invoices quickly using filters:

- Invoice code (e.g., NYC-A1B2C3)

- Status (paid/unpaid)

- Customer

Invoice PDFs

Every invoice can be downloaded as a professional PDF:

- Automatically generated from invoice data

- Includes your business logo and branding

- Shows all line items, discounts, VAT, and totals

- Displays payment status (Paid, Unpaid)

- Includes a QR code for easy mobile payment (for unpaid invoices)

- Can be printed or saved for records

Customers can download the PDF from their payment link, making it easy to keep records or share with their accounting department.

Export Invoice Data

Export your invoice data to CSV files for accounting or custom analysis purposes.

Creating an Export

- Navigate to Exports in your location dashboard

- Select "Invoices" as the resource type

- Choose optional filters:

- Date range (created date)

- Status (paid or unpaid)

- Customer

- Submit

Downloading Exports

- Exports are processed in the background

- You'll see the status change from pending/processing to completed

- Download files within 7 days (automatic cleanup after)

Customer Access

Your customers can view their invoices directly in Paydough by signing in.

This gives customers a better self-service experience with a single place to track what they owe and make payments without searching through email.

Best Practices

Due Date Selection

- Net 15: Payment due 15 days after invoice date

- Net 30: Payment due 30 days after invoice date

- Due on Receipt: Payment expected immediately

Choose due dates that match your business policies and industry standards.

Clear Line Item Descriptions

Write descriptions that clearly explain what the customer is paying for:

- "Monthly SEO Services - January 2024"

- "Website Design - Homepage Redesign"

- "Consulting - Billed Per Hour"

Clear descriptions reduce customer questions and payment delays.

Timely Sending

Send invoices promptly after completing work:

- Customers remember the value provided

- Faster invoicing leads to faster payment

- Reduces confusion about what's being billed

Follow-Up on Overdue Invoices

Monitor unpaid invoices that are past due:

- Review aging reports weekly

- Contact customers with overdue balances

- Consider payment plans for large amounts

Common Workflows

Standard Billing Workflow

- Complete work for customer

- Create invoice with line items

- Send invoice to customer

- Customer pays via payment link

- Invoice marked as paid

- Revenue recorded in analytics

Recurring Customer Workflow

- Create recurring invoice with line items

- Customer receives invoice on due date

- Customer's payment method is stored

- Payment charged automatically going forward

- Invoice marked as paid

- Customer receives receipt

Quote-Based Workflow

- Create and send quote to customer

- Customer accepts quote

- Paydough automatically creates invoice from quote

- Paydough sends invoice to customer

- Customer pays

- Invoice marked as paid

See the Quotes Workflow guide for more details on this process.

Products

Products are the items and services you sell to customers. Build a product catalog to speed up invoice and quote creation with pre-filled pricing, descriptions, and tax rates.

Quotes

Quotes let you send proposals to customers before billing them. When a customer accepts a quote, Paydough automatically converts it into an invoice, streamlining your sales-to-billing process.